The Benefits of Owning Los Angeles Investment Properties in High GRM and Cap Rate Neighborhoods

Los Angeles is a diverse and dynamic city with a thriving real estate market. For investors looking to build wealth through property ownership, Los Angeles offers a range of opportunities in neighborhoods with high Gross Rent Multipliers (GRMs) and Capitalization Rates (Cap Rates). In this blog post, we’ll explore the benefits of owning investment property in these neighborhoods and how you can get started.

What are GRM and Cap Rate?

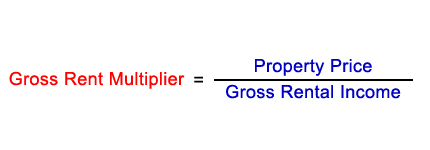

Before we dive into the benefits of owning investment property in high GRM and Cap Rate neighborhoods, let’s define these terms. GRM is a ratio used to measure the value of an investment property based on its rental income. It is calculated by dividing the property’s price by its annual rental income. The higher the GRM, the more expensive the property is relative to its rental income.

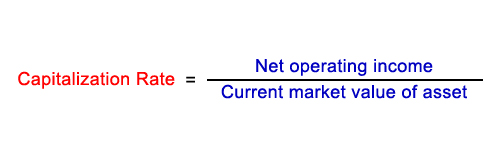

Cap Rate, on the other hand, is a ratio used to measure the return on investment for an income-producing property. It is calculated by dividing the property’s net operating income (NOI) by its purchase price. The higher the Cap Rate, the better the return on investment.

Benefits of Owning Investment Property in High GRM and Cap Rate Neighborhoods

- Strong Rental Demand

Investment properties in high GRM and Cap Rate neighborhoods tend to have strong rental demand due to their affordability and desirable location. This means that landlords can expect steady rental income and low vacancy rates. - Appreciation Potential

Los Angeles real estate has historically appreciated over time, and properties in high GRM and Cap Rate neighborhoods have even greater appreciation potential due to their affordability and increasing demand. This means that investors can build equity over time while generating rental income. - Diversification of Investment Portfolio

Investment property ownership provides diversification for your investment portfolio, as it is not tied to stock market fluctuations. In addition, owning property in different neighborhoods with varying GRMs and Cap Rates can further diversify your investment portfolio.

How to Get Started

If you’re interested in owning investment property in high GRM and Cap Rate neighborhoods, the first step is to find a knowledgeable real estate agent who specializes in investment properties. I can help you identify neighborhoods with strong rental demand and appreciation potential, as well as provide guidance on financing options.

To stay up-to-date on the latest listings and market updates, use this CONTACT FORM to receive an MLS customer search account. This will give you access to the most current information on investment properties in Los Angeles.

Top 3 Reference URLs

- Wikipedia – Gross Rent Multiplier (GRM)

https://en.wikipedia.org/wiki/Gross_rent_multiplier - Wikipedia – Capitalization Rate (Cap Rate)

https://en.wikipedia.org/wiki/Capitalization_rate - Rent Cafe – Average Rent in Los Angeles

https://www.rentcafe.com/average-rent-market-trends/us/ca/los-angeles/